Novartis AG – Annual report – 31 December 2025

Industry: pharmaceuticals

10. Right-of-use assets and lease liabilities

The Company recognizes a right-of-use asset and a corresponding lease liability for all arrangements in which it is a lessee, except for leases with a term of 12 months or less (short-term leases) and low-value leases. For these short-term and low-value leases, the Company recognizes the lease payments as an operating expense on a straight-line basis over the term of the lease. The Company allocates the consideration in the lease contract to the lease and non-lease components on the basis of the relative standalone price of each component.

The portion of the lease payments attributable to the repayment of lease liabilities is recognized in cash flows used in financing activities, and the portion attributable to the payment of interest is included in cash flows from operating activities.

Right-of-use assets are depreciated on a straight-line basis from the commencement date of the lease over the shorter of the useful life of the right-of-use asset or the end of the lease term.

Right-of-use assets are assessed for impairment whenever there is an indication that the balance sheet carrying amount may not be recoverable using cash flow projections for the useful life.

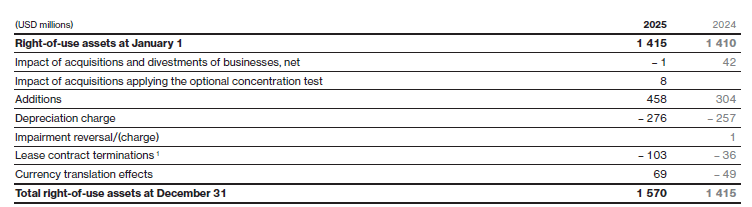

The following table summarizes the movements of the right-of-use assets:

1 Lease contract terminations also includes modifications to existing leases that result in reductions to the right-of-use assets, and reductions due to sub-leasing.

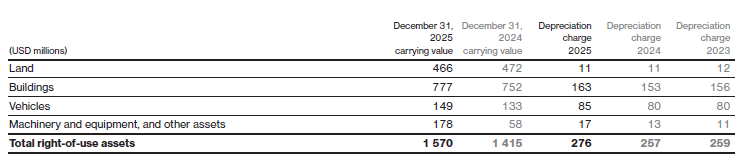

The following table shows the right-of-use assets carrying value at December 31, 2025 and 2024, and the continuing operations depreciation charge for years 2025, 2024 and 2023, by underlying class of asset1:

1 Note 29 provides disclosure of discontinued operations depreciation charge.

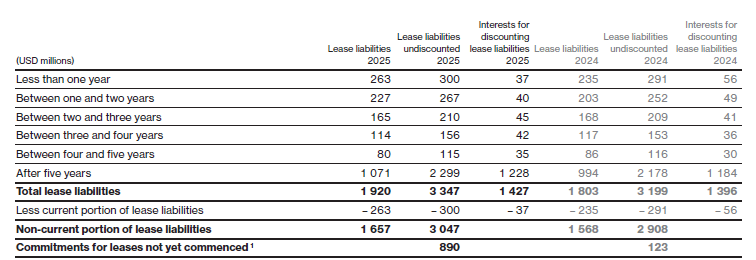

The following table shows the lease liabilities by maturity at December 31, 2025 and 2024:

1 The 2025 estimated timing of the commitments for leases not yet commenced are as follows: 2026 USD 38 million, 2027 USD 6 million, 2028 USD 23 million, 2029 USD 47 million, 2030 USD 48 million and thereafter USD 728 million.

At December 31, 2025 and 2024, there were no material future cash outflows, including extension options, excluded from the measurement of lease liabilities. The Company’s most material lease with a lease term extension, representing a lease liability value of USD 0.7 billion (2024: USD 0.7 billion), has a determined lease term end date of 2071 (2024: 2071). Non-enforceable extension options of up to 10 years have not been included within the measurement of this lease liability, and do not have a material impact to the carrying value of the lease for either 2025 or 2024. Should the landlord agree to a lease extension, rent will be referenced to the market rates as at the commencement of the extension period.

In 2025, the Company completed one sale and leaseback transaction (2024: two, 2023: two) as part of its facilities strategy. This generated USD 32 million in net cash (2024: USD 9 million, 2023: USD 273 million). This transaction resulted in no lease liability (2024: USD 14 million, 2023: USD 146 million) and USD 1 million in right-of- use assets (2024: USD 2 million, 2023: USD 109 million). Extension options were included where assessed likely to be exercised. The transaction resulted in a net gain of USD 21 million (2024: net loss of USD 10 million, 2023: net gain of USD 18 million).

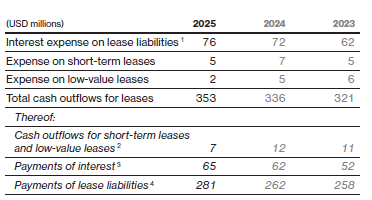

The following table provides additional disclosures related to continuing operations right-of-use assets and lease liabilities for 2025, 2024 and 2023:

1 The weighted average interest rate is 4.1% (2024: 4.0%, 2023: 3.5%).

2 Cash flows from short-term and low-value leases are included within total net cash flows from operating activities. The portfolio of short-term leases to which the Company is committed to at December 31, 2025, 2024 and 2023, is similar to the portfolio of short-term leases the Company entered into during 2025, 2024 and 2023.

3 Included within total net cash flows from operating activities

4 Reported as cash outflows in financing activities net of lease incentives received, if any.

The net investment held and income from subleasing right-of-use assets, as well as income from leasing Novartis property, plant and equipment to third parties were not significant for 2025, 2024, or 2023.