Barratt Developments PLC – Annual report – 30 June 2017

Industry: real estate

Other statutory disclosures (extracts)

Directors’ Report

The Directors’ Report for the financial year ended 30 June 2017 comprises pages 45 to 112 inclusive, together with the sections incorporated by reference. Any matters on which the Directors are required to report on annually, but which do not appear in any other section of this report are detailed below.

Appointment and removal of Directors

In accordance with the Articles there shall be no less than two and no more than 15 Directors appointed to the Board at any one time. Directors may be appointed by the Company by ordinary resolution or by the Board. The Board may from time to time appoint one or more Directors to hold employment or executive office for such period (subject to the Companies Act 2006 (the ‘Act’)) and on such terms as they may determine and may revoke or terminate any such appointment. Directors are not subject to a maximum age limit.

In addition to the power under the Act for shareholders to remove any Director by ordinary resolution upon the giving of special notice, under the Articles the Company may, by special resolution, remove any Director before the expiration of their term of office. The office of Director shall be vacated if: (i) they resign or offer to resign and the Board resolves to accept such offer; (ii) their resignation is requested by all of the other Directors and all of the other Directors are not less than three in number; (iii) they are or have been suffering from mental or physical ill health; (iv) they are absent without permission of the Board from meetings of the Board for six consecutive months and the Board resolves that their office is vacated; (v) they become bankrupt or compound with their creditors generally; (vi) they are prohibited by law from being a Director; (vii) they cease to be a Director by virtue of the Act; or (viii) they are removed from office pursuant to the Articles.

Details relating to the retirement, election and re-election of Directors at each AGM can be found in the Nomination Committee report on pages 62 and 63.

Powers of the Directors

Subject to the Articles, the Act and any directions given by special resolution, the business of the Company is ultimately managed by the Board who may exercise all the powers of the Company, whether relating to the management of the business of the Company or otherwise. In particular, the Board may exercise all the powers of the Company to borrow money and to mortgage or charge any of its undertakings, property, assets and uncalled capital and to issue debentures and other securities and to give security for any debt, liability or obligation of the Company to any third party.

Capital structure

The Company has a single class of share capital which is divided into ordinary shares of 10 pence each. All issued shares are in registered form and are fully paid. Details of the Company’s issued share capital and of the movements in the share capital during the year can be found in note 5.6 to the Financial Statements on page 155. Subject to the Articles, the Act and other shareholders’ rights, shares are at the disposal of the Board. At each AGM the Board seeks authorisation from its shareholders to allot shares. At the AGM held on 16 November 2016, the Directors were given authority to allot shares up to a nominal value of £33,462,297 (representing one-third of the nominal value of the Company’s issued share capital as at 30 September 2016), such authority to remain valid until the end of the 2018 AGM or, if earlier, until the close of business on 16 February 2018. A resolution to renew this authority will be proposed at the 2017 AGM.

Rights and obligations attaching to shares

Subject to any rights attached to existing shares, shares may be issued with such rights and restrictions as the Company may by ordinary resolution decide, or (if there is no such resolution or so far as it does not make specific provision) as the Board may decide.

Subject to the Act, the Articles specify that rights attached to any existing class of shares may be varied either with the written consent of the holders of not less than three-fourths in nominal value of the issued shares of that class (excluding any shares of that class held as treasury shares), or with the sanction of a special resolution passed at a separate general meeting of the holders of those shares. The rights conferred upon the holders of any shares shall not, unless otherwise expressly provided in the rights attaching to those shares, be deemed to be varied by the creation or issue of further shares ranking pari passu with them.

Voting

Subject to any special terms as to voting upon any shares which may be issued or may at the relevant time be held, every member present in person or by proxy at a general meeting or class meeting has one vote upon a show of hands or, upon a poll vote, one vote for every share of which such member is a holder. In the case of joint holders of a share, the vote of the senior who tenders a vote, whether in person or by proxy, shall be accepted to the exclusion of votes of the other joint holders and seniority shall be determined by the order in which the names stand in the register in respect of the joint holding.

In accordance with the Act, each member is entitled to appoint one or more proxies, and in the case of corporations, more than one corporate representative to exercise all or any of their rights to attend, speak and vote on their behalf at a general meeting or class meeting. The timescales for appointing proxies are set out in the Notice of the 2017 AGM.

No member shall be entitled to vote at any general meeting or class meeting in respect of any shares held by them if any call or other sum then payable by them in respect of that share remains unpaid or if they have been served with a restriction notice (as defined in the Articles) after failure to provide the Company with information concerning interests in those shares required to be provided under the Act.

Transfer of shares

Shares in the Company may be in uncertificated or certificated form. Title to uncertificated shares may be transferred by means of a relevant system and certificated shares may be transferred by an instrument of transfer as approved by the Board. The transferor of a share is deemed to remain the holder until the transferee’s name is entered into the Company’s register of members.

There are no restrictions on the transfer of shares except as follows. The Board may, in its absolute discretion and without giving any reason, decline to register any transfer of any share which is not a fully paid share. Registration of a transfer of an uncertificated share may be refused in the circumstances set out in the uncertificated securities rules (as defined in the Articles) and where, in the case of a transfer to joint holders, the number of joint holders to whom the uncertificated share is to be transferred exceeds four.

The Board may decline to register a transfer of a certificated share unless the instrument of transfer: (i) is duly stamped or certified or otherwise shown to the satisfaction of the Board to be exempt from stamp duty and is accompanied by the relevant share certificate and such other evidence of the right to transfer as the Board may reasonably require; (ii) is in respect of only one class of share; (iii) if joint transferees, is in favour of not more than four such transferees; or (iv) where the transfer is requested by a person with a 0.25% interest (as defined in the Articles) if such a person has been served with a restriction notice after failure to provide the Company with information concerning interests in those shares required to be provided under the Act, unless the transfer is shown to the Board to be pursuant to an arm’s length sale (as defined in the Articles).

There are no special control rights in relation to the Company’s shares and the Company is not aware of any agreements between holders of securities that may result in restrictions on the transfer of securities.

Shareholder authority for purchase of own shares

At the Company’s AGM held on 16 November 2016, shareholders gave authority to the Company to buy back up to an aggregate of 100,386,890 ordinary shares (representing 10% of the Company’s issued share capital). This authority is valid until the end of the 2017 AGM or, if earlier, until the close of business on 16 February 2018. Under the authority there is a minimum and maximum price to be paid for such shares. Any shares which are bought back may be held as treasury shares or, if not so held, will be cancelled immediately upon completion of the purchase, thereby reducing the Company’s issued share capital.

No purchases had been made under this authority as at the date of this Annual Report and Accounts. A resolution renewing the authority will be proposed at the 2017 AGM.

Shareholder arrangements to waive dividends

The Barratt Developments Employee Benefit Trust (the ‘EBT’) holds ordinary shares in the Company for the purpose of satisfying options and awards that have been granted under the various employee share schemes operated by the Company. Details of the shares so held are set out in note 5.6 to the Financial Statements.

The EBT has agreed to waive all or any future right to dividend payments on shares held within the EBT and these shares do not count in the calculation of the weighted average number of shares used to calculate EPS until such time as they are vested to the relevant employee. This waiver will not apply to any shares held under an award to which dividend equivalents apply.

The Trustees of the EBT may vote or abstain from voting on shares held in the EBT in any way they think fit and in doing so may take into account both financial and non-financial interests of the beneficiaries of the EBT or their dependants.

Employee share schemes

Details of employee share schemes are set out in note 6.3 to the Financial Statements. Details of long term incentive schemes for the Directors are shown in the Remuneration report on pages 92 to 105.

Articles of Association

The Company’s Articles of Association (the ‘Articles’) contain regulations which deal with matters such as the appointment and removal of Directors, Directors’ interests and proceedings at general and Board meetings. Any amendments to the Articles may be made in accordance with the provisions of the Companies Act 2006 by way of a special resolution at a general meeting.

Significant agreements

The following significant agreements as at 30 June 2017 contained provisions entitling the counterparties to exercise termination or other rights in the event of a change of control of the Company:

- The revolving credit facility agreement dated 14 May 2013 (as amended on 17 December 2014, 30 June 2016 and 29 December 2016) made between, amongst others, the Company, Lloyds Bank Plc (as the facility agent) and the banks and financial institutions named therein as lenders (the ‘Revolving Credit Facility Agreement’) contains a prepayment provision at the election of each lender on change of control. The Company must notify the facility agent promptly upon becoming aware of the change of control. After the occurrence of a change of control, the facility agent shall (if a lender so requests within 20 days of being notified of the change of control) by notice to the Company, on the date falling 30 days after the change of control, cancel the commitment of such lender under the Revolving Credit Facility Agreement and declare all amounts outstanding in respect of such lender under the Revolving Credit Facility Agreement immediately due and payable. The Revolving Credit Facility Agreement also contains a provision such that, following a change of control, a lender is not obliged to fund any further drawdown of the facility (other than rollover loans). For these purposes, a ‘change of control’ occurs if any person or group of persons ‘acting in concert’ (as defined in the City Code on Takeovers and Mergers) gains control (as defined in the Corporation Tax Act 2010) of the Company.

- Each of the note purchase agreements entered into in respect of the Group’s privately placed notes (being the US$80m of notes issued pursuant to the following note purchase agreements: (i) a note purchase agreement in respect of the issue of US$15m notes dated 10 May 2011 (as amended and restated on 14 May 2013 and as amended on 17 December 2014); and (ii) a note purchase agreement in respect of the issue of US$65m notes also dated 10 May 2011 (as amended and restated on 14 May 2013 and as amended on 17 December 2014)) contains a change of control prepayment provision. Each such control provision provides that promptly after the Company becomes aware that a change of control has occurred, the Company shall notify all the holders of the notes of the same and give the noteholders the option to require the Company to prepay at par all outstanding amounts (principal and interest) under the notes. If a noteholder accepts such offer of prepayment, such prepayment shall take place on a business day that is not more than 90 days after the Company notified the noteholders of the change of control. For these purposes a ‘change of control’ means the acquisition by a person or a group of persons ‘acting in concert’ (as defined in the City Code on Takeovers and Mergers) such that they gain beneficial ownership of more than 50% of the issued share capital of the Company carrying voting rights. As explained in the post Balance Sheet event on page 106 the Group refinanced this US Private Placement. Full disclosure of the new private placement will be made in the 2018 Annual Report and Accounts.

- Each of the debt facility agreements (based on a proforma agreement agreed in October 2012) between the Company (as guarantor), BDW (as borrower and developer) and the Homes and Communities Agency (‘HCA’) (as lender), whereby the HCA has made up to £33m (in aggregate) of project financing available to fund up to 20 development sites, contains a provision requiring BDW Trading Limited to obtain the consent of the HCA on a change in control of the Company, BDW or any of their holding companies (if relevant). The HCA is entitled to withhold its consent to such a change in control if the new controller does not have sufficient reputation, financial standing or organisational standing and capacity. A failure to: (i) obtain the HCA’s consent to a change in control; and (ii) provide the HCA with notice of the change in control within a specified time period, is an event of default under each of these agreements. On such an event of default the HCA may, by notice in writing to BDW, terminate each debt facility agreement and require BDW to prepay the project financing. For these purposes a ‘change in control’ means the acquisition by a person or a group of persons acting together such that they gain beneficial ownership of more than 50% of the issued share capital or voting rights of the relevant company, have the right to appoint the majority of the Directors of the relevant company or otherwise control the votes at Board meetings of the relevant company.

The note purchase agreements also impose upon the holders customary restrictions on resale or transfer of the notes, such as the transfer being subject to a de minimis amount.

Remuneration report – Directors’ Remuneration Policy (extract 1)

Executive Directors’ policy on payment on loss of office

There are no specific provisions for compensation on early termination (except for payment in lieu of holidays accrued but untaken) or loss of office due to a change of ownership of the Company.

Remuneration report – Directors’ Remuneration Policy (extract 2)

Change of control – the rules of each share scheme operated by the Company contain provisions relating to a change of control. In the event that a change of control does occur any unvested options or awards will become vested on the date of the relevant event. However, the number of options or awards that vest will be pro-rated depending on the number of weeks completed within the relevant performance period and the level of performance conditions achieved during that period. Options or awards which have already vested as at the date of the relevant event may still be exercised within the prescribed timescales set out in the rules.

Corporate governance report (extract)

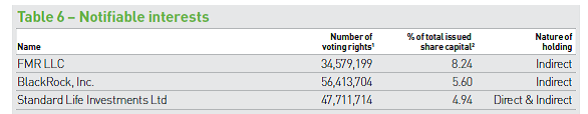

Major shareholders

In accordance with the UKLA’s Disclosure Guidance and Transparency Rules (the ‘DTRs’), all notifications received by the Company are published on the Company’s website http://www.barrattdevelopments.co.uk and via a Regulatory Information Service.

As at 30 June 2017, the persons set out in Table 6 have notified the Company, pursuant to DTR 5.1, of their interests in the voting rights in the Company’s issued share capital:

1 Represents the number of voting rights last notified to the Company by the respective shareholder in accordance with DTR 5.1.

2 Based on the Total Voting Rights as at the relevant notification dates.

At 5 September 2017, no change in these holdings had been notified and no further notifications of a disclosable interest had been received.

The Total Voting Rights of the Company as announced on 1 September 2017, are 1,009,901,161.