Telia Company AB (publ) – Annual report – 31 December 2021

Industry: telecoms

C2. Judgments and key sources of estimation uncertainty (extract)

Accounts payables under vendor financing arrangements

Telia Company has arrangements with several banks under which the banks offer Telia Company’s vendors the option to receive earlier payment of Telia Company’s accounts payables. Vendors utilizing the financing arrangement pay a credit fee to the bank. Telia Company does not pay any credit fees and does not provide any additional collateral or guarantee to the bank. Based on Telia Company’s assessment the liabilities under the vendor financing arrangement are closely related to operating purchase activities and the financing arrangement does not lead to any significant change in the nature or function of the liabilities. These liabilities are therefore classified as accounts payables with separate disclosures in the notes. The credit period does not exceed 12 months and the accounts payables are therefore not discounted. Account payables under vendor financing arrangements were SEK 11,001 million per December 31, 2021 (8,535). See Note C25.

C3. Significant accounting policies (extract)

Trade receivables and trade payables – measurement

Trade receivables are initially recognized at fair value, normally being the invoiced amount, and subsequently carried at invoiced amount less allowance for expected credit losses, which equals amortized cost since the terms are generally 30 days and the impact of discount would be immaterial. An estimate of the amount of allowance for expected credit losses is recognized and reduces the carrying amount of the trade receivables. An impairment loss on trade receivables is calculated as the difference between the carrying amount and the present value of the estimated future cash flow. Bad debts are written-off when identified and charged to Selling and marketing expenses. Accrued trade receivables are recognized at the amounts expected to be billable.

Trade payables are initially recognized at fair value, normally being the invoiced amounts, and subsequently measured at invoiced amounts, which equals amortized cost, using the effective interest rate method, since generally the payments terms are such that the impact of discounting would be immaterial.

Accounts payable under vendor financing arrangements are closely related to operating purchase activities and the financing arrangement does not lead to any significant change in the nature or function of the liabilities. These liabilities are therefore classified as accounts payables, but are specified in the disclosures. The credit period does not exceed 12 months and the accounts payables are therefore not discounted.

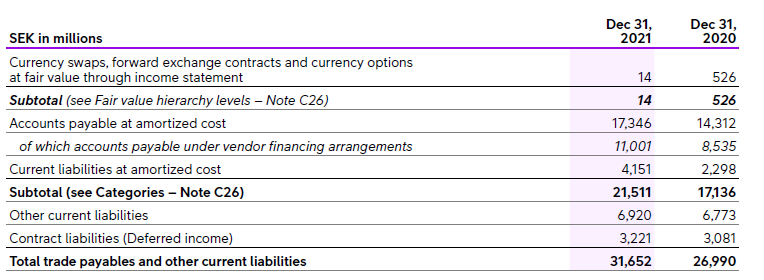

C25. Trade payables and other current liabilities

Trade payables and other current liabilities were distributed as follows.

For accounts payable and current liabilities, the carrying value equals fair value as the impact of discounting is insignificant. See Note C26 for more information on financial instruments classified by category/fair value hierarchy level and to Note C27 on management of liquidity risk. Telia Company has arrangements with several banks under where the banks offers Telia Company’s vendors the option to receive earlier payment of Telia Company’s accounts payables. Vendors utilizing the financing arrangement pay a credit fee to the bank. Telia Company does not pay any credit fees and does not provide any additional collateral or guarantee to the bank.

As of December 31, 2021, contractual cash flows for liabilities at amortized cost represented the following expected maturities.

Corresponding information for currency derivatives held-for-trading are presented in section “Liquidity risk management” to Note C27.

The main components of current liabilities are accrued payables to suppliers and accrued interconnect and roaming charges, while other current liabilities mainly entail value-added tax, advances from customers and accruals of payroll expenses and social security contributions.

Contract liabilities (Deferred income) mainly relate to subscription and other telecom charges.