Mitchells & Butlers plc – Annual report – 27 September 2025

Industry: food and drink

3.1 Property, plant and equipment

Accounting policies

Property, plant and equipment

The majority of the Group’s freehold and long leasehold licensed land and buildings, and the associated landlord’s fixtures, fittings and equipment (i.e. fixed fittings) are revalued annually and are therefore held at fair value less depreciation. Tenant’s fixtures and fittings (i.e. loose fixtures) within freehold and long leasehold properties, are held at cost less depreciation and impairment.

Short leasehold buildings (leases with an unexpired lease term of less than 50 years), unlicensed land and buildings and associated fixtures, fittings and equipment are held at cost less depreciation and impairment.

Land and buildings include leasehold improvements on long and short leases. All land and buildings are disclosed as a single class of asset within the property, plant and equipment table, as we do not consider the short leasehold and unlicensed buildings to be material for separate disclosure.

Non-current assets held for sale are held at their carrying value or their fair value less costs to sell where this is lower.

Depreciation

Depreciation is charged to the income statement on a straight-line basis to write off the cost less residual value over the estimated useful life of an asset and commences when an asset is ready for its intended use. Expected useful lives and residual values are reviewed each period and adjusted if appropriate. No adjustments have been made in the period.

Freehold land is not depreciated.

Freehold and long leasehold buildings are depreciated so that the difference between their carrying value and estimated residual value is written off over 50 years from the date of acquisition. The residual value of freehold and long leasehold buildings is reassessed each period and is estimated to be equal to the fair value determined in the annual valuation and therefore no depreciation charge is recognised.

Short leasehold buildings, and associated fixtures and fittings, are depreciated over the shorter of the estimated useful life and the unexpired term of the lease.

Fixtures, fittings and equipment have the following estimated useful lives:

Information technology equipment: 3 to 7 years

Fixtures and fittings 3 to 20 years

At the point of transfer to non-current assets held for sale, depreciation ceases. Should an asset be subsequently reclassified to property, plant and equipment, the depreciation charge is calculated to reflect the cumulative charge had the asset not been reclassified.

Disposals

Profits and losses on disposal of property, plant and equipment are calculated as the difference between the net sales proceeds and the carrying amount of the asset at the date of disposal.

Revaluation

The revaluation, performed at 27 September 2025, is determined via annual third-party inspection of 20% of the sites with the aim that all sites are individually valued approximately every five years. The valuation utilises estimates of fair maintainable trade (FMT) and valuation multiples. The revaluation determined by the annual inspection was carried out in accordance with the RICS Valuation – Global Standards 2025 which incorporate the International Valuation Standards and the RICS Valuation – Professional Standards UK (the ‘Red Book’) assuming each asset is sold as a fully operational trading entity.

Properties are valued as fully operational entities, to include fixtures and fittings but excluding stock, tenant’s fixtures and fittings and personal goodwill.

The 80% of the freehold and long leasehold estate which is not subject to a third-party valuation in the period is instead revalued internally by management. The Group’s external valuer provides advice to management in relation to their internal valuation. This valuation is performed using estimates of FMT, together with the same valuation multiples as those applied by the external valuer. Sites impacted by expansionary capital investment in the preceding twelve months are reviewed for impairment only, based on estimated annualised post investment FMT against the carrying value of the asset. Where the value of land and buildings derived purely from a multiple applied to the FMT misrepresents the underlying asset value, a spot valuation is applied.

Surpluses which arise from the revaluation exercise are included within other comprehensive income (in the revaluation reserve) unless they are reversing a revaluation deficit which has been recognised in the income statement previously; in which case an amount equal to a maximum of that recognised in the income statement previously is recognised in the income statement. Where the revaluation exercise gives rise to a deficit, this is reflected directly within the income statement, unless it is reversing a previous revaluation surplus against the same asset; in which case an amount equal to the maximum of the revaluation surplus is recognised within other comprehensive income (in the revaluation reserve).

Impairment

Short leaseholds, unlicensed properties and fixtures and fittings are reviewed on an outlet basis for impairment if events or changes in circumstances indicate that the carrying amount may not be recoverable. Further details of the impairment policy are provided in the impairment note 3.3.

Accounting judgements

Revaluation of freehold and long leasehold properties

The revaluation methodology is determined, with advice from CBRE, independent chartered surveyors, and incorporates management judgement where appropriate. The application of a valuation multiple to the FMT of each site is considered the most appropriate method for the Group to determine the fair value of freehold and long leasehold licensed land and buildings.

In the current and prior period, judgement has been applied to establish the basis of FMT that a willing third-party buyer would assume. The estimation of FMT is derived from the individual profit and loss accounts of pubs and restaurants and is inclusive of the centrally recorded trading margins earned by the Group but exclusive of certain head office costs. This represents the Group’s best view of the value that would be attributed by other reasonably efficient operators. In both the current and prior periods FMT is estimated with reference to the reported site performance, with averages of the last two years performance taken in the current period.

Where sites have been impacted by expansionary capital investment in the preceding twelve months, the FMT has been determined by estimating annualised post-investment operating profit with reference to post-investment forecasts. See sensitivity analysis on page 146 regarding sites with investment in the current period.

For the purposes of the valuation, and in order to group together properties of a similar nature, groupings by brand are applied for which standard multiples have been established through third-party inspections of 20% of the freehold and long leasehold licensed property estate. Judgements are applied in assessing multiples on the basis of market evidence of transaction prices and nature of the overall offer within the local market, with specific consideration given to geographical location, ancillary revenue such as accommodation sales from bedrooms and lease terms for long leasehold sites.

Further judgement is required when a spot valuation is applied where the property value derived purely from a multiple applied to the FMT misrepresents the underlying asset value with consideration given to the level of trade and location characteristics.

Significant accounting estimates

Revaluation of freehold and long leasehold properties

The application of the valuation methodology requires two significant estimates; the estimation of valuation multiples, which are determined via third-party inspections; and an estimate of FMT.

In the prior period, inflation and costs stabilised, such that the Group’s external valuer considered that the level of reported site profitability was representative of the FMT that a third-party, reasonably efficient operator would include in arriving at a transaction price. In the current period, trading conditions have remained stable, and the Group’s external valuer has determined FMT as the average of the current and prior period reported site profitability for all sites other than those impacted by investment in either period, or sites that have been spot valued.

The estimation of valuation multiples is derived from the valuer’s knowledge of market evidence of transaction prices for similar properties. In the current period the multiples adopted are mostly in line with the prior period.

There is considered to be a significant risk that an adjustment to either of these assumptions could lead to a material change in the property valuation within the next year.

A sensitivity analysis of changes in valuation multiples and FMT, in relation to the properties to which these estimates apply, is provided on page 146.

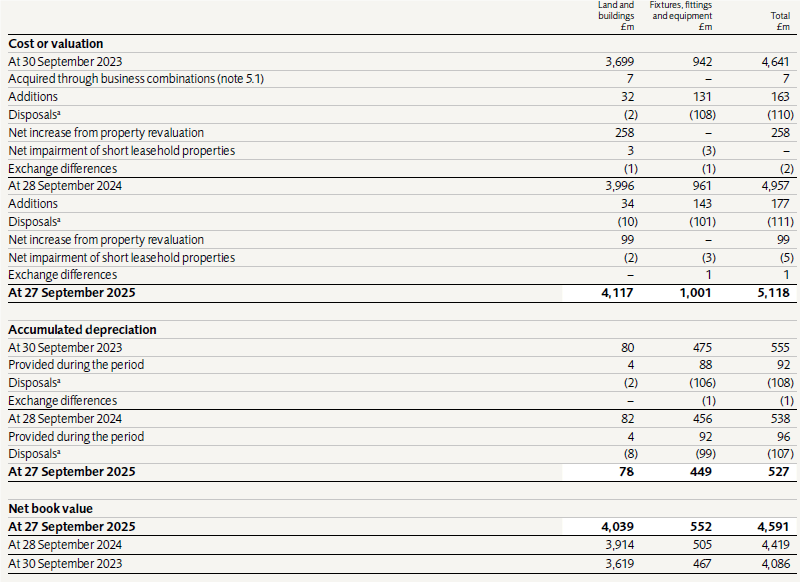

Property, plant and equipment

Property, plant and equipment can be analysed as follows:

a. Includes assets which are fully depreciated and have been removed from the fixed asset register.

Land and buildings include leasehold improvements on long and short leases with a net book value of £332m (2024 £314m).

Certain assets with a net book value of £46m (2024 £44m) owned by the Group are subject to a fixed charge in respect of liabilities held by the Mitchells & Butlers Executive Top-Up Scheme (MABETUS).

Included within property, plant and equipment are assets with a net book value of £3,832m (2024 £3,697m), which are pledged as security for the securitisation debt and over which there are certain restrictions on title. Further details of the securitisation are provided in note 4.1.

Cost at 27 September 2025 includes £19m (2024 £14m) of assets in the course of construction.

Revaluation of freehold and long leasehold properties

The fair value has been determined by estimations of FMT and brand valuation multiples. In the current period, FMT is largely reflective of the average of current and prior period reported profits. Consideration has been given to location, quality of the pub restaurant and recent market transactions in the sector in assessing property multiples. In the prior period FMT was largely reflective of reported profits.

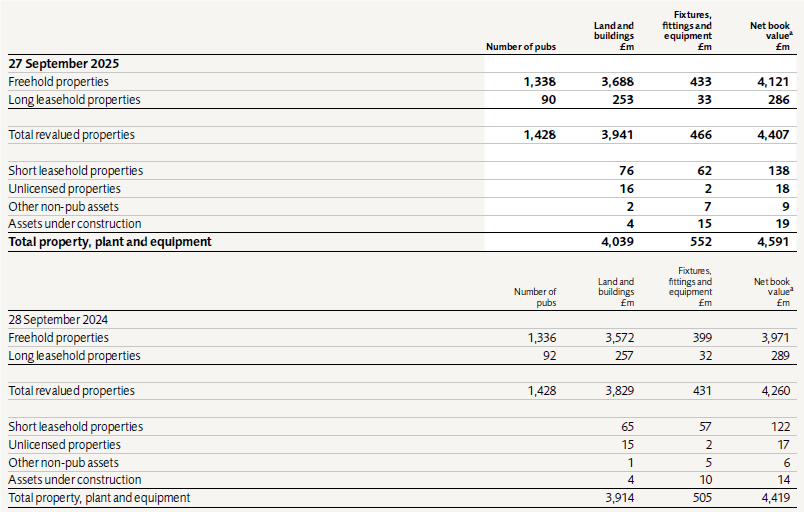

Sensitivity analysis

Changes in the FMT, or the multiple could materially impact the valuation of the freehold and long leasehold properties, and as such they are both considered to be significant estimates in the current period. The carrying value of properties to which these estimates apply is £4,407m (2024 £4,260m).

FMT

In the current period, FMT has increased by 1% over the prior period’s FMT, excluding the sites with investment in the current period which are only assessed for impairment. Given trading has now normalised following the disruption caused by the Covid pandemic in 2020, and there is a more stable inflationary environment, a return to pre Covid FMT movements is considered to be within range of reasonably possible outcomes. Over the three years reported prior to Covid the average movement in the FMT of the revalued estate was 1%. Assuming multiples remain stable, it is estimated that a 1% reduction in the FMT would generate an approximate £36m reduction in the valuation. A 1% increase in the FMT is estimated to generate an approximate £38m increase in the valuation. The sensitivity does not apply to sites with spot valuations as these valuations are independent of reported operating profits. Any change to the spot valuations would not be material.

Multiples

Valuation multiples are determined at an individual brand level. Over the last three financial periods, the weighted average brand multiple has moved by an average of 0.1, which is considered to be within the range of reasonably possible outcomes for future movements in multiples. It is estimated that a 0.1 reduction in the multiple would generate an approximate £42m reduction in the valuation. A 0.1 increase to the multiple is estimated to generate an approximate £44m increase in the valuation.

Sites with investment in the current period

205 properties were subject to investment over the last 12 months and, consistent with the Group’s policy have been valued at previous valuation plus the associated investment capital expenditure as an approximation of current valuation. Trading results in the period immediately following an investment in a site are less predictable and are therefore not taken into the assessment of fair maintainable trade until a year has passed. There is a reasonable possibility that the valuation of the invested properties will move materially over the next 12 months as the post investment trading pattern becomes clearer. Over the last two financial periods, the invested property portfolio has seen a valuation uplift in the year subsequent to the investment. If this pattern continues during FY 2026, then the uplift recognised on FY 2025 invested properties could represent around 2.8% of the overall property estate valuation. This is completely dependent on the individual performance of those sites and past experience also indicates that there is a risk of downward movements. The invested properties are reviewed for impairment, based on estimated annualised post investment FMT against the carrying value of the asset as described in the revaluation policy.

Impairment review

Short leasehold and unlicensed properties (comprising land, buildings, fixtures, fittings and equipment) which are not revalued to fair market value, are reviewed for impairment as described in the impairment note 3.3. A net impairment of £5m (2024 £nil) has been recognised against short leasehold and unlicensed properties in the period.

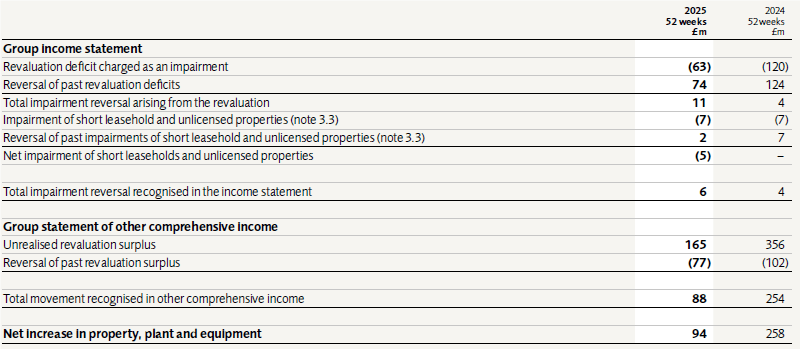

Revaluation and impairment recognised

Current period valuations have been incorporated into the consolidated financial statements and the resulting revaluation adjustments have been taken to the revaluation reserve or Group income statement as appropriate.

The impact of the revaluations/impairments described above is as follows:

The valuation techniques are consistent with the principles in IFRS 13 and use significant unobservable inputs such that the fair value measurement of each property within the portfolio has been classified as Level 3 in the fair value hierarchy.

The number of pubs included in the revaluation and the resulting valuation of these properties is reconciled to the total value of property, plant and equipment below.

a. The carrying value of freehold and long leasehold properties based on their historical cost is £2,654m and £186m respectively (2024 £2,581m and £180m).

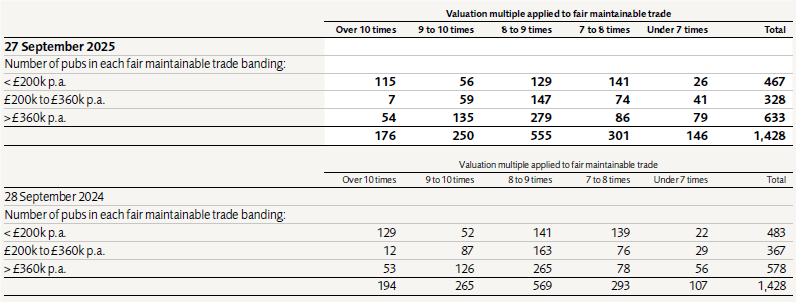

The tables below show, for revalued properties, the number of pubs that have been valued within each fair maintainable trade and multiple banding:

Movements in valuation multiples between financial periods are the result of changes in property market conditions. The average weighted multiple is 8.5 (2024 8.7).

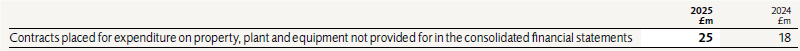

Capital commitments