Stora Enso Oyj – Annual report – 31 December 2025

Industry: forestry, manufacturing

Country-by-country reporting of income taxes

Stora Enso provides information on the Group’s tax approach and reports details of the corporate income taxes paid by the Group as required by EU Public Country by Country Reporting Directive 2021/2101. The aim of the Directive is to strengthen corporate social responsibility by disclosing how companies support local welfare through country-by-country tax payments and prevent harmful tax practices.

In this report, Stora Enso describes its tax policy and approach to tax and explains its processes around tax governance, controls, and risk management. Moreover, Stora Enso describes how it engages with stakeholders and deals with any concerns there may be related to tax. The Group also discloses a report of the corporate income taxes paid and accrued, and other financial country-by-country information as required by the Directive.

Tax policy

The Stora Enso Tax Policy addresses the Group’s tax strategy, including approach to tax, tax governance, compliance, tax risk management and tax authority co-operation. The Tax Policy has been approved by the President and CEO of Stora Enso and is reviewed annually. This report discusses the principles of the Tax Policy.

Approach to tax

As a responsible taxpayer, Stora Enso is committed to observing the letter and the spirit of applicable tax laws, rules and regulations, including international transfer pricing guidelines and local legislation in all jurisdictions where it conducts business activities or has otherwise any tax obligation. In addition to legal and regulatory requirements, the tax principles comply with Stora Enso’s values to ‘Lead’ and ‘Do what’s right’. The strategic priorities of Stora Enso’s tax function are confirmed annually by the Group CFO.

Stora Enso seeks to ensure that the tax strategy is aligned with the Group’s business and commercial strategy. Stora Enso only undertakes tax planning that is duly aligned to economic activity and does not take aggressive tax planning positions. This means that all tax decisions are made in response to commercial activity, and tax is one of many other factors that are considered when making business decisions. Stora Enso has an obligation to manage tax costs as part of the Company’s financial responsibility to societies and shareholders. Stora Enso may therefore respond to tax incentives and exemptions granted by governments on reasonable grounds, and currently has operations in countries that offer favourable tax treatments, where their location also is justified by sound commercial considerations.

The joint operation Montes del Plata operates a pulp mill in a Special Economic Zone with favourable tax treatment in Uruguay. As of 2024 the operations are subject to the global minimum tax requirement under the OECD Pillar Two rules, with potential additional tax.

In addition, Stora Enso conducts business, mainly consisting of sales support services, in the United Arab Emirates, Singapore, and Hong Kong.

Tax governance, control, and risk management

Stora Enso acts, as part of protecting shareholder value, with integrity in all tax matters. The Group’s Tax team, reporting to the Group CFO, works closely with the businesses and other internal stakeholders to identify and manage business and compliance tax risks to ensure a sustainable yet business feasible platform for operations. The Group’s Tax team regularly reports key tax matters to the Group management and the Finance and Audit Committee of the Board of Directors.

Tax affairs are managed under an extensive set of Group policies and guidelines. Internal stakeholders are continuously trained on tax-related matters to enhance capabilities and improve overall tax compliance and quality of tax reporting. Compliance processes are subject to internal controls, and tax risks are annually reviewed as part of the Group’s risk management process. The Tax team monitors changes in tax legislation and regularly reviews tax affairs and risks with stakeholders to ensure that Stora Enso can sufficiently identify, assess, and mitigate tax risk.

In case employees have any concerns about unethical or unlawful behaviour or the Company’s integrity, the anonymous Speak Up Hotline can be used to report any suspected cases also regarding tax matters.

Stakeholder engagement and concerns related to tax

Stora Enso’s commitment to tax transparency is also reflected in the Group’s relationships with tax authorities and governments. Stora Enso seeks to work positively, proactively and openly with tax authorities on a global basis, utilising transparent advance processes to minimise potential disputes. Stora Enso also works with government representatives, mainly through associations, by providing corporate views and impacts at request to aid law-making and implementation. Stora Enso responds to investor enquiries and constantly follows the development of tax sustainability and transparency expectations.

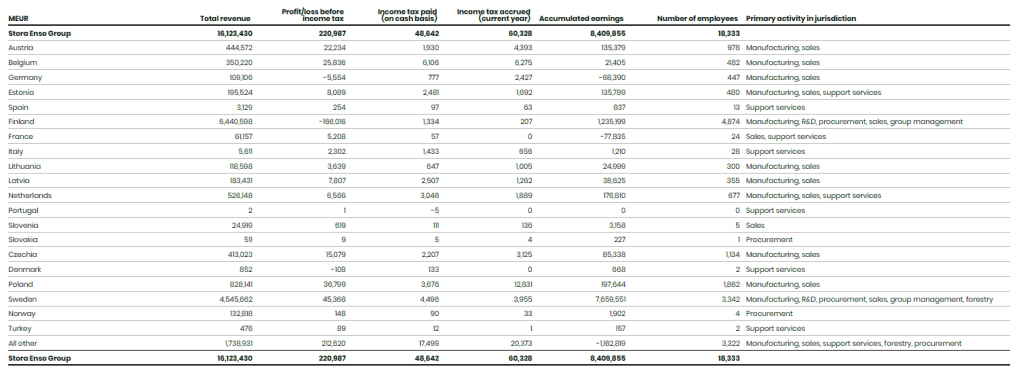

Country-by-country reporting of income taxes in 2025: How to read the report

The country-by country (CbC) data is reported according to the EU Directive 2021/2101. The directive requires reporting of financial information for all entities located in European Economic Area (EEA) per country. Also, entities in specified jurisdictions which are listed as “non-cooperative” by the EU are reported per country, and the rest of the countries in aggregate. The required financial information in the CbC report is the sum of the legal entities’ local standalone IFRS reported balances in each country. Group level consolidation adjustments, such as elimination of group internal transactions, are excluded. Due to this the financial information does not fully reconcile to what is presented in the consolidated financial statements for 2025. The reported amounts exclude value adjustments and group internal dividends.

In the CbC report, revenues represent the total amount of income of the entities in the jurisdiction.

Profit/loss before tax is the total amount of the group entities’ profit or loss before tax in the jurisdiction, as reported under IFRS. The reported amounts include differences between accounting and taxation, such as depreciation differences, and thus do not represent the taxable income on which taxes are calculated in the jurisdiction’s taxation.

Income tax paid on a cash basis contains the total of income taxes paid or received during the reported period by the companies in the jurisdiction to the home jurisdiction and all other jurisdictions. The amount contains tax payments and refunds for previous years and excess payments refundable in following years. Therefore, the cash tax payment is not directly comparable to the reported profit or loss before tax for the reporting period.

Income tax accrued on profit/loss is the IFRS reported current tax expense of the reported period. The amounts do not include deferred taxes from temporary differences and tax losses and thus do not represent the total tax expense of the entities in the income statement. The amounts do not contain taxes from previous periods.

Accumulated earnings consist of the retained earnings under IFRS of the companies in the jurisdiction. Number of employees is the number of fulltime equivalents in the jurisdiction at the end of the year. Primary activities in the jurisdiction lists the main activities of all group entities in the jurisdiction.

Country-by-country information for financial year 2025

The Group’s ultimate parent company is Stora Enso Oyj (Finland). The list of Stora Enso group subsidiaries can be found in section 6.2 of the Notes to the consolidated financial statements in the Annual Report. The table below provides the country-by-country financial information for 2025 on entities established in the EEA countries or specified jurisdictions which are listed as “non-cooperative” by the EU, reported in thousand euros.

A Finnish language version of the public country-by-country reporting can be found here.

Country-by-country information for financial year 2025