Imperial Brands PLC – Annual report – 30 September 2025

Industry: tobacco

Material accounting policies (extract)

Taxes (extract)

Uncertain tax positions are assessed and measured on an issue by issue basis within the jurisdictions where we operate using management’s estimate of the most likely outcome. Where management determines that a greater than 50% probability exists that the tax authorities would accept the position taken in the tax return, amounts are recognised in the consolidated financial statements on that basis. Where the amount of tax payable or recoverable is uncertain, the Group recognises a liability or asset based on either: management’s judgement of the most likely outcome; or, when there is a wide range of possible outcomes, a probability weighted average approach. The Group recognises interest on late paid taxes as part of financing costs. The Group recognises penalties, if applicable, as part of administrative and other expenses when the charges are considered to be arbitrary and not directly part of the applicable tax code. Where this is not the case they are recorded with the tax charge.

2. ACCOUNTING ESTIMATES AND JUDGEMENTS (extract)

Estimates (extract)

Significant estimates

Companies are required to state whether estimates have a significant risk of a material adjustment to the carrying amounts of assets and liabilities within the next financial year. We have reviewed the items below where estimation uncertainty exists. While a number of these areas do involve estimation of the carrying value of assets or liabilities that are potentially significant within the context of the financial statements, the Group considers the probability of a significant risk of material adjustment to be low. None of these estimates are expected to present a material adjustment to the carrying amount of assets and liabilities in the next financial year.

Other estimates (extract)

Other estimates involve other uncertainties, such as those carrying lower risk, which have a smaller potential impact or would be expected to crystallise over a longer time frame than a significant estimate. These items, listed below, are only disclosed where this provides material relevant information.

Corporate income taxes

Where tax liabilities have been judged to exist, estimation is often required to determine the potential future tax payments. The Group is subject to tax in numerous jurisdictions and significant estimation is required in determining the provision for tax. There are many transactions and calculations for which the ultimate tax determination is uncertain. The Group recognises provisions for tax based on estimates of the taxes that are likely to become due. Where the final tax outcome is different from the amounts that were initially recorded, such differences will impact the current income tax and deferred tax provisions in the period in which such determination is made. Consideration of the valuation estimates related to tax provisions is given in note 8 to these financial statements.

Judgements (extracts)

Paragraph 122 of IAS 1 requires disclosure of judgements made by management in applying an entity’s accounting policies, other than those relating to estimation uncertainty. Paragraph 125 of IAS 1 requires more wide-ranging disclosures of judgements that depend on management assumptions about the future, and other major sources of estimation uncertainty (“significant judgements”).

Corporate income taxes

Judgement is involved in determining whether the Group is subject to a tax liability or not in line with tax law. The Group is subject to income tax in numerous jurisdictions and significant judgement is required in determining whether there is a liability requiring a provision for tax. Recognition of tax liabilities in situations where there is uncertainty is based on precedent in similar tax cases and external advice as to whether challenges by tax authorities are likely to result in future tax payments being made. The recognition of a tax liability involves consideration of the probability of tax authorities accepting the position taken in the tax return and there is therefore some uncertainty.

Deferred tax assets

Deferred tax assets are recognised for deductible temporary differences, unused tax losses and unused tax credits to the extent that it is probable that taxable profit will be available against which the temporary differences, losses and credits can be utilised. Significant management judgement is required to determine the amount of deferred tax assets that can be recognised, based upon the likely timing and the level of future taxable profits, together with future tax planning strategies. The Group has determined that it cannot recognise deferred tax assets on the temporary differences, tax losses and tax credits carried forward for certain subsidiaries. Further details of the estimates related to deferred taxes are given in note 23 to these financial statements.

8. TAX (extract)

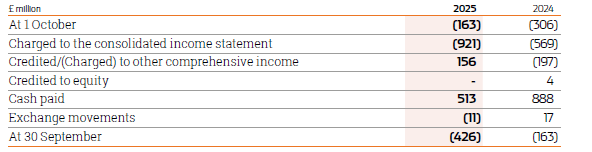

Movement on the current tax account

The cash tax paid in the year is £408 million lower than the current tax charge (2024: £319 million higher). This arises as a result of timing differences between the accrual of income taxes and the actual payment of cash and the movement in the provision for uncertain tax positions.

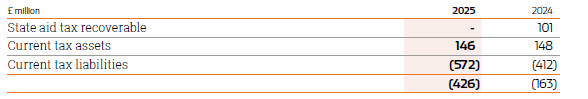

Analysis of current tax account

Uncertain tax positions

As an international business the Group is exposed to uncertain tax positions and changes in legislation in the jurisdictions in which it operates. The Group’s uncertain tax positions principally include cross border transfer pricing, interpretation of new or complex tax legislation and tax arising on the valuation of assets.

Provisions arising from uncertain tax positions taken in the calculation of tax assets and liabilities are included within current and deferred tax liabilities. At 30 September 2025 the total value of these provisions excluding offsetting assets under mutual agreement procedure was £387 million (2024: £365 million excluding offsetting assets). The assessment of uncertain tax positions is subjective and significant management judgement is required. This judgement is based on current interpretation of legislation, management experience and professional advice. Until matters are finally concluded it is possible that amounts ultimately paid will be different from the amounts provided.

Management have assessed the Group’s provision for uncertain tax positions and have concluded that apart from the matters referred to below the provisions in place are not material individually or in aggregate, and that a reasonably possible change in the next financial year would not have a material impact on the results of the Group.

French tax litigation

The Group has successfully prevailed in an ongoing litigation with the French tax authorities, a matter which had the potential to result in total liabilities amounting to £254 million, inclusive of tax, interest, and penalties. The challenge concerned the valuation placed on the shares of Altadis Distribution France (now known as Logista France) following an intragroup transfer of shares in October 2012 and the tax consequences flowing from a potentially higher value that was argued for by the tax authorities. In May 2023 the Administrative Tribunal of Montreuil issued its decision, ruling in favour of the French tax authorities. As a result, all associated liabilities including tax, interest and penalties were paid by 28 February 2025. In March 2025, the Group was then successful in its appeal to the Administrative Court of Appeal of Paris. In light of the binding nature of the Court’s decision, the French Tax Authorities proceeded with a full reimbursement of the amounts previously paid of £261 million. Subsequently, in May 2025, the French Tax Authorities lodged an appeal with the French Administrative Supreme Court (“Conseil d’État”). A public hearing was held in June 2025 to assess the admissibility of the appeal. Ultimately, the Supreme Court rejected the appeal, thereby confirming the favourable ruling of the Administrative Court of Appeal as final and conclusively resolving the litigation. As a consequence, the tax provision of £170 million was released.

State aid UK CFC

In April 2019, the EU Commission’s final decision regarding its investigation into the UK’s Controlled Foreign Company regime was published. It concluded that the legislation up until December 2018 partially represented state aid. The UK Government (along with a number of UK corporates, that made a similar application) appealed to the European Court seeking annulment of the EU Commission’s decision. Based, however, on the Commission’s decision and despite the appeals, the UK Government was obliged to recover the purported state aid received. In June 2022 the European General Court rejected the appeals, resulting in a subsequent appeal to the CJEU in January 2024. The CJEU handed down its decision on 19th September 2024, annulling the EU Commission decision and setting aside the judgment of the General Court, ruling that the taxation of controlled foreign companies (CFCs) regime did not constitute State Aid. During the 30 September 2025 period the group received a refund of c.£101 million state aid and c.£9 million of interest previously paid for which a receivable was recognised in the 30 September 2024 period. Additional interest was also received of c.£9 million.

Transfer pricing

The Group has been subject to tax audits relating to transfer pricing matters in several jurisdictions, principally UK, France and Germany. The Group holds a provision of £381 million excluding offsetting assets (30 September 2024: £245 million excluding offsetting assets) in respect of these items. In December 2021 the Group concluded a transfer pricing audit with the French tax authorities. In September 2022 the Group concluded transfer pricing audits with the UK and German tax authorities. Settlements of the French and UK audits were made during 2022. Settlement of the German audit was made during 2023. Mutual Agreement Procedure (MAP) proceedings are currently ongoing in relation to these audits to resolve potential double taxation issues arising from the settlements. In September 2023 an additional separate transfer pricing audit was opened by the German tax authorities. Due to regulations introduced in Germany within 30 September 2024 period which could be considered to be merely of a clarifying nature rather than any new principle, the Group maintained a provision of £156 million considering the range of potential outcomes and the balance of probabilities associated with each potential outcome, the maximum potential exposure being £404 million. Following correspondence with the tax authorities in the current financial year. The Group believes that an additional provision of £21 million (€24 million) on top of the £156 million already recorded is required to reflect the more likely outcome.

Transfer Pricing/ Controlled Foreign Company (“CFC”)

Imperial Brands Enterprise Finance Limited (IBEFL) is a corporation which is tax resident in the UK. Reemtsma Cigarettenfabriken GmbH (Reemtsma) holds approx. 83.95% of the shares in IBEFL. As part of the tax audit, the German tax authorities are challenging the application of the German CFC regulations on IBEFL and have also requested further details on IBEFL’s intercompany transactions. As a result of these challenges the Group believes that a provision for a total amount of £79 million (€96 million) is required.