3i Group plc – Annual report – 31 March 2025

Industry: investments

C Critical accounting judgements and estimates (extract)

(b) Critical estimates (extract)

I. Fair valuation of the investment portfolio

The investment portfolio, a material group of assets of the Group, is held at fair value. Details of valuation methodologies used and the associated sensitivities are disclosed in Note 13 Fair values of assets and liabilities in this document. Given the importance of this area, the Board has a separate Valuations Committee to review the valuations policies, process and application to individual investments. A report on the activities of the Valuations Committee (including a review of the assumptions made) is included in the Valuations Committee report on pages 130 to 134.

13 Fair values of assets and liabilities (extract)

(B) Valuation

The fair values of the Group’s financial assets and liabilities not held at fair value, are not materially different from their carrying values, with the exception of loans and borrowings. The fair value of the loans and borrowings is £1,115 million (31 March 2024: £1,166 million), determined with reference to their published market prices. The carrying value of the loans and borrowings is £1,194 million (31 March 2024: £1,202 million) and accrued interest payable (included within trade and other payables) is £29 million (31 March 2024: £29 million).

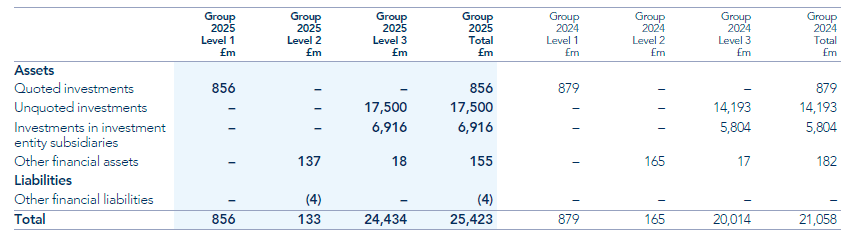

Valuation hierarchy

The Group classifies financial instruments measured at fair value according to the following hierarchy:

Unquoted equity instruments and debt instruments are measured in accordance with the IPEV Guidelines with reference to the most appropriate information available at the time of measurement. Further information regarding the valuation of unquoted equity instruments can be found on page 179.

The table below shows the classification of financial instruments held at fair value into the valuation hierarchy at 31 March 2025:

We determine that, in the ordinary course of business, the net asset value of an investment entity subsidiary is considered to be the most appropriate to determine fair value. The underlying portfolio is valued under the same methodology as directly held investments, with any other assets or liabilities within investment entity subsidiaries fair valued in accordance with the Group’s accounting policies.

Note 12 details the Directors’ considerations about the fair value of the underlying investment entity subsidiaries.

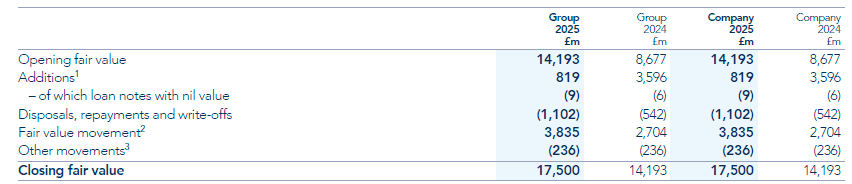

Movements in the directly held investment portfolio categorised as Level 3 during the year are set out in the table below:

1 The table in Note 11 reconciles additions.

2 All fair value movements relate to assets held at the end of the year and are recognised in unrealised profits on the revaluation of investments.

3 Other movements include the impact of foreign exchange and accrued interest.

Unquoted investments valued using Level 3 inputs also had the following impact on profit and loss: realised profits over value on disposal of investments of £5 million (2024: £1 million), dividend income of £380 million (2024: £332 million) and foreign exchange losses of £245 million (2024: £238 million).

Assets move between Level 1 and Level 3 when an unquoted equity investment lists on a quoted market exchange. There were no transfers in or out of Level 3 during the year. In the 12 months to 31 March 2025, one asset changed valuation basis within Level 3, moving from a DCF based valuation to an other basis. Action remains unchanged on an earnings-based valuation. The changes in valuation methodology in the period reflect our view of the most appropriate method to determine the fair value of these assets at 31 March 2025. Further information can be found in the Private Equity and Infrastructure sections of the Business and Financial reviews starting on page 19.

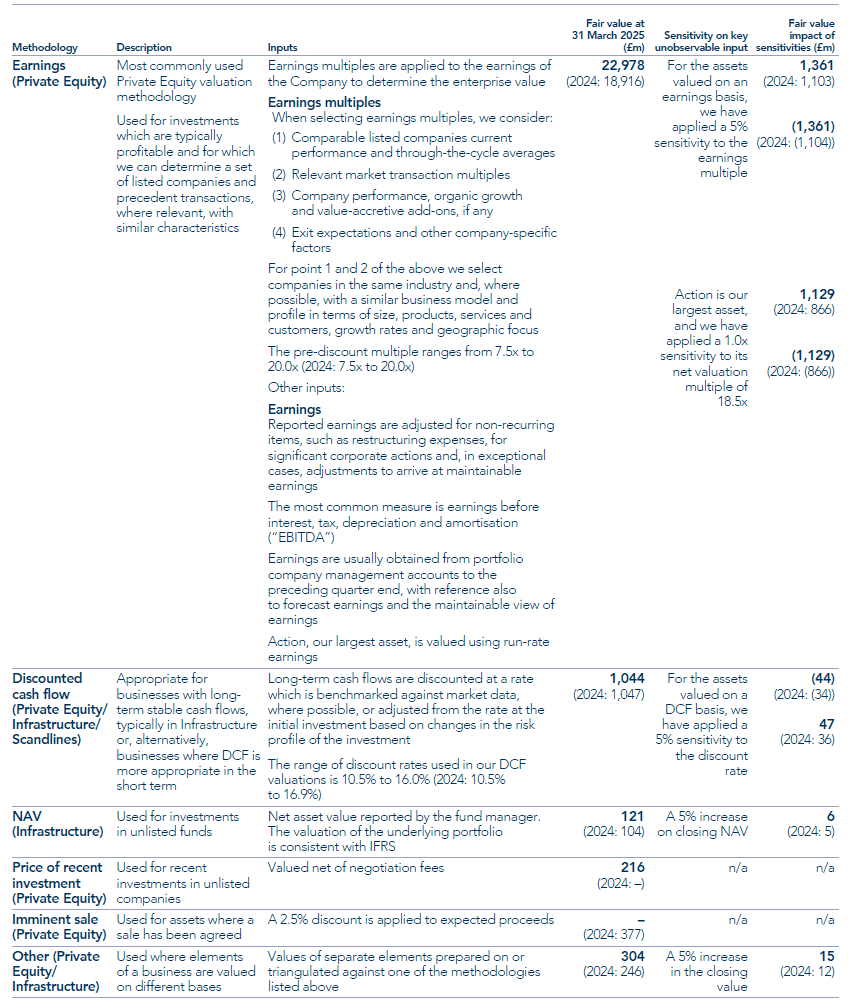

The following table summarises the various valuation methodologies used by the Group to fair value Level 3 instruments, the inputs and the sensitivities applied and the impact of those sensitivities to the unobservable inputs. Overall, our portfolio companies have delivered a strong performance, against a backdrop of a challenging macro-economic and geopolitical conditions, including the recent tariff announcements. These factors have been important considerations in our portfolio valuations at 31 March 2025. As part of our case-by-case review of our portfolio companies the risks and opportunities from climate change are an important consideration in the overall discussion on fair value and where relevant and possible, we embed certain climate-related considerations in the valuations. These risks are adequately captured in the multiple sensitivity. All numbers in the table below are on an Investment basis.

Level 3 unquoted investments

27 Financial risk management (extract)

Market risk (extract 1)

The valuation of the Group’s investment portfolio is largely dependent on the underlying trading performance of the companies within the portfolio, but the valuation and other items in the financial statements can also be affected by interest rate, currency and quoted market fluctuations. The Group’s sensitivity to these items is set out below.

Market risk (extract 2)

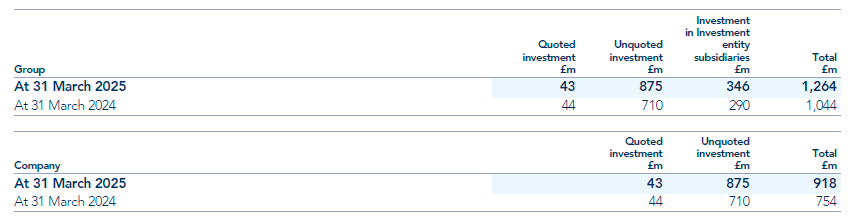

(iii) Price risk – market fluctuations

The Group’s management of price risk, which arises primarily from quoted and unquoted equity instruments, is through the careful consideration of the investment, asset management and divestment decisions at the Investment Committee. The Investment Committee’s role in risk management is detailed on page 82 in the Risk management section. A 5% change in the fair value of those investments would have the following direct impact in profit or loss:

Portfolio and other information (extract page 211)

Portfolio valuation – an explanation

Policy

The valuation policy is the responsibility of the Board, with additional oversight and annual review from the Valuations Committee. The policy is reviewed at least annually, with the last update in January 2025. Our policy is to value 3i’s investment portfolio at fair value and we achieve this by valuing investments on an appropriate basis, applying a consistent approach across the portfolio. The policy ensures that the portfolio valuation is compliant with the fair value guidelines under IFRS and, in so doing, is also compliant with the IPEV guidelines. The policy covers the Group’s Private Equity, Infrastructure and Scandlines investment valuations. Valuations of the investment portfolio of the Group and its subsidiaries are performed at each quarter end.

Fair value is the underlying principle and is defined as “the price that would be received to sell an asset in an orderly transaction between market participants at the measurement date” (IPEV guidelines, December 2022). Fair value is an estimate and, as such, determining fair value requires the use of judgement.

The quoted assets in our portfolio are valued at their closing bid price at the balance sheet date. The majority of the portfolio, however, is represented by unquoted investments.

Private Equity unquoted valuation

To arrive at the fair value of the Group’s unquoted Private Equity investments, we first estimate the entire value of the company we have invested in – the enterprise value. We then apportion that enterprise value between 3i, other shareholders and lenders.

Determining enterprise value

The enterprise value is determined using one of a selection of methodologies depending on the nature, facts and circumstances of the investment.

Where possible, we use methodologies which draw heavily on observable market prices, whether listed equity markets or reported merger and acquisition transactions, and trading updates from our portfolio.

As unquoted investments are not traded on an active market, the Group adjusts the estimated enterprise value by a liquidity discount. The liquidity discount is applied to the total enterprise value and we apply a higher discount rate for investments where there are material restrictions on our ability to sell at a time of our choosing.

Note 13 Fair values of assets and liabilities outlines in more detail the range of valuation methodologies available to us, as well as the inputs and adjustments necessary for each. The fair value of each investment has been assessed on a case-by-case basis considering historical, current and forward looking data. Where forward-looking data forms the base of a valuation, the accuracy, reliability and maintainability of these forecasts has been considered.

Apportioning the enterprise value between 3i, other shareholders and lenders

Once we have estimated the enterprise value, the following steps are taken:

(1) We subtract the value of any claims, net of free cash balances that are more senior to the most senior of our investments.

(2) The resulting attributable enterprise value is apportioned to the Group’s investment, and equal ranking investments by other parties, according to contractual terms and conditions, to arrive at a fair value of the entirety of the investment. The value is then distributed amongst the different loan, equity and other financial instruments accordingly.

(3) If the value attributed to a specific shareholder loan investment in a company is less than its carrying value, a shortfall is implied, which is recognised in our valuation. In exceptional cases, we may judge that the shortfall is temporary; to recognise the shortfall in such a scenario would lead to unrepresentative volatility and hence we may choose not to recognise the shortfall.

Other factors

In applying this framework, there are additional considerations that are factored into the valuation of some assets.

Impacts from structuring

Structural rights are instruments convertible into equity or cash at specific points in time or linked to specific events. For example, where a majority shareholder chooses to sell, and we have a minority interest, we may have the right to a minimum return on our investment.

Debt instruments, in particular, may have structural rights. In the valuation, it is assumed third parties, such as lenders or holders of convertible instruments, fully exercise any structural rights they might have if they are “in the money”, and that the value to the Group may therefore be reduced by such rights held by third parties. The Group’s own structural rights are valued on the basis they are exercisable on the reporting date.

Infrastructure unquoted valuation

The primary valuation methodology used for unquoted Infrastructure investments is the DCF method. Fair value is estimated by deriving the present value of the investment using reasonable assumptions of expected future cash flows and the terminal value and date, and the appropriate risk-adjusted discount rate that quantifies the risk inherent to the investment. The discount rate is estimated with reference to the market risk-free rate, a risk-adjusted premium and information specific to the investment or market sector.

Scandlines unquoted valuation

Scandlines is valued on a DCF basis. This is consistent with the Infrastructure methodology.